Sales Tax Exemption Form

As you know, MasVida has always taken the position that is does not charge sales tax on the rental of therapeutic devises. This position has been taken as MasVida has always believed the rental of these medical devises for a specific individual, under a prescription, is not taxable. To continue with this practice, we have now been advised to obtain our customers affirmation that they are acquiring the items as the patients’ agent, on their patients’ behalf and based upon the patient’s prescription. I know we have spoken to several of our clients who have reiterated that this position is correct and that they could make this statement in an exemption certificate.

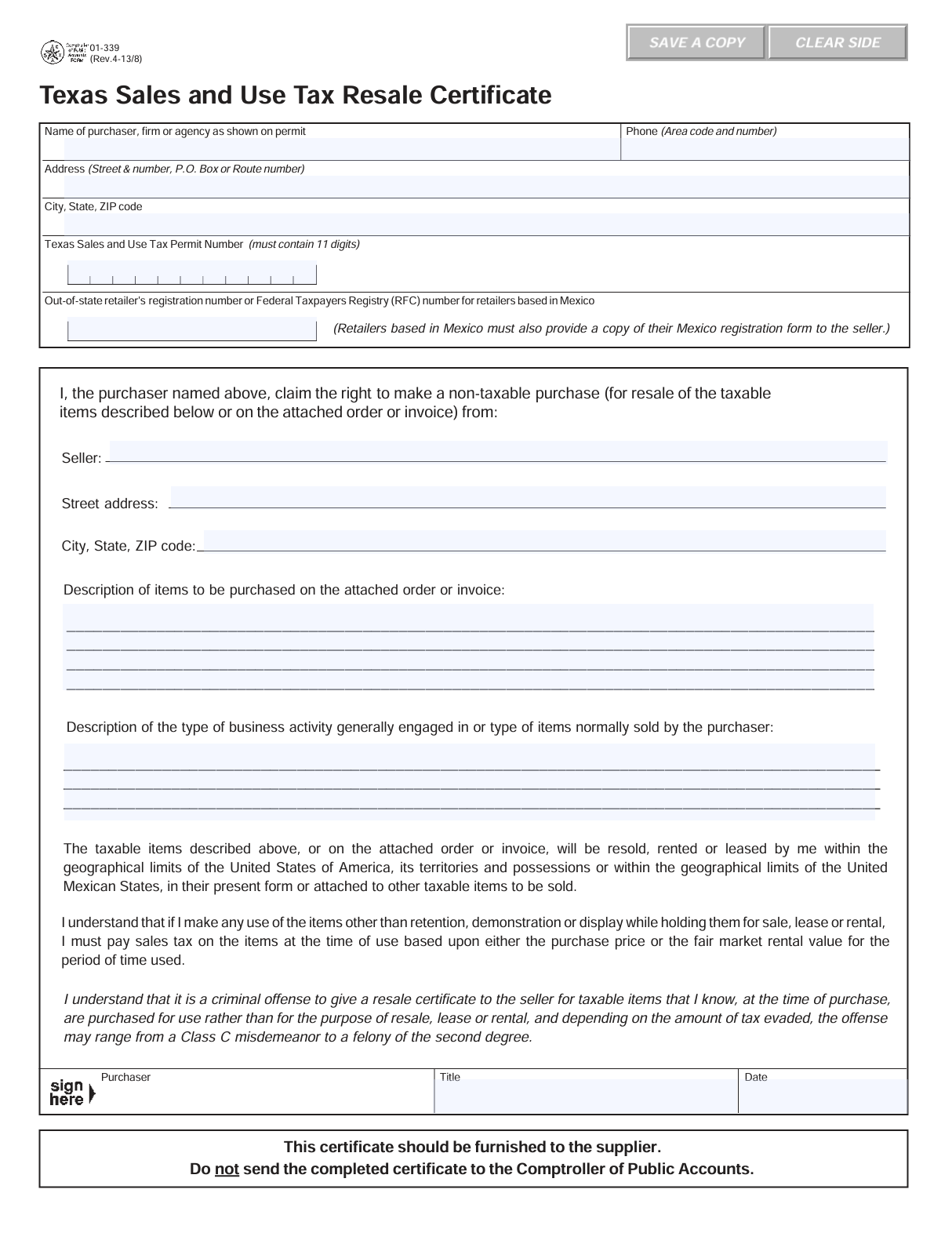

Accordingly, please find an exemption certificate below.

Please return the certificate to billing@masvidahealth.com as soon as possible.

To be abundantly clear, we are not tax advisors and are not giving you tax advice. Rather, if you do not believe you can make the statement contained in the exemption certificate, or believe you are otherwise entitled to an exemption from sales tax, please fill out the form and return to us ASAP. Likewise, if you do not believe you are exempt from taxes, please let us know. If you have any questions, please do not hesitate to reach out to us.